There’s no doubt about it: assessing your financial situation is the least enjoyable part of the otherwise exciting homebuying process. Still, it’s critical for homebuyers to know their financial situation and how it affects their ability to buy.

One of the most important aspects of this is what credit score is needed to buy a home — and how yours will affect your potential buying power.

In the sections that follow, we’ll cover reasons why lenders look at your credit score, how they use it, and how it affects your ability to purchase a home.

Quick Takeaways

- Mortgage lenders look at credit scores to determine suitability for a mortgage loan.

- Borrowers with higher credit scores earn lower interest rates and pay less interest over the life of their loan. Borrowers with lower credit scores earn higher interest rates and pay more interest over the life of their loan.

- Mortgage lenders also look at debt-to-income ratio, or the percentage of monthly income that goes toward paying debts.

- Potential homebuyers should always know their credit score and debt-to-income ratio before applying for a mortgage loan.

Why do home mortgage lenders check credit scores?

Mortgage lenders check homebuyer credit scores to assess their level of risk as a borrower. Your credit score also helps lenders determine the best loan amount and interest rate to offer you. Even for first time home buyers, credit score provides powerful insight into your financial history and responsibility as it relates to debt.

Typically, mortgage companies will look at your FICO score and copies of your credit report from the three major credit bureaus — Equifax, Experian, and TransUnion. This gives lenders a complete picture of your credit history and allows them to make an informed decision about whether or not to approve your loan.

What credit score is needed to buy a home?

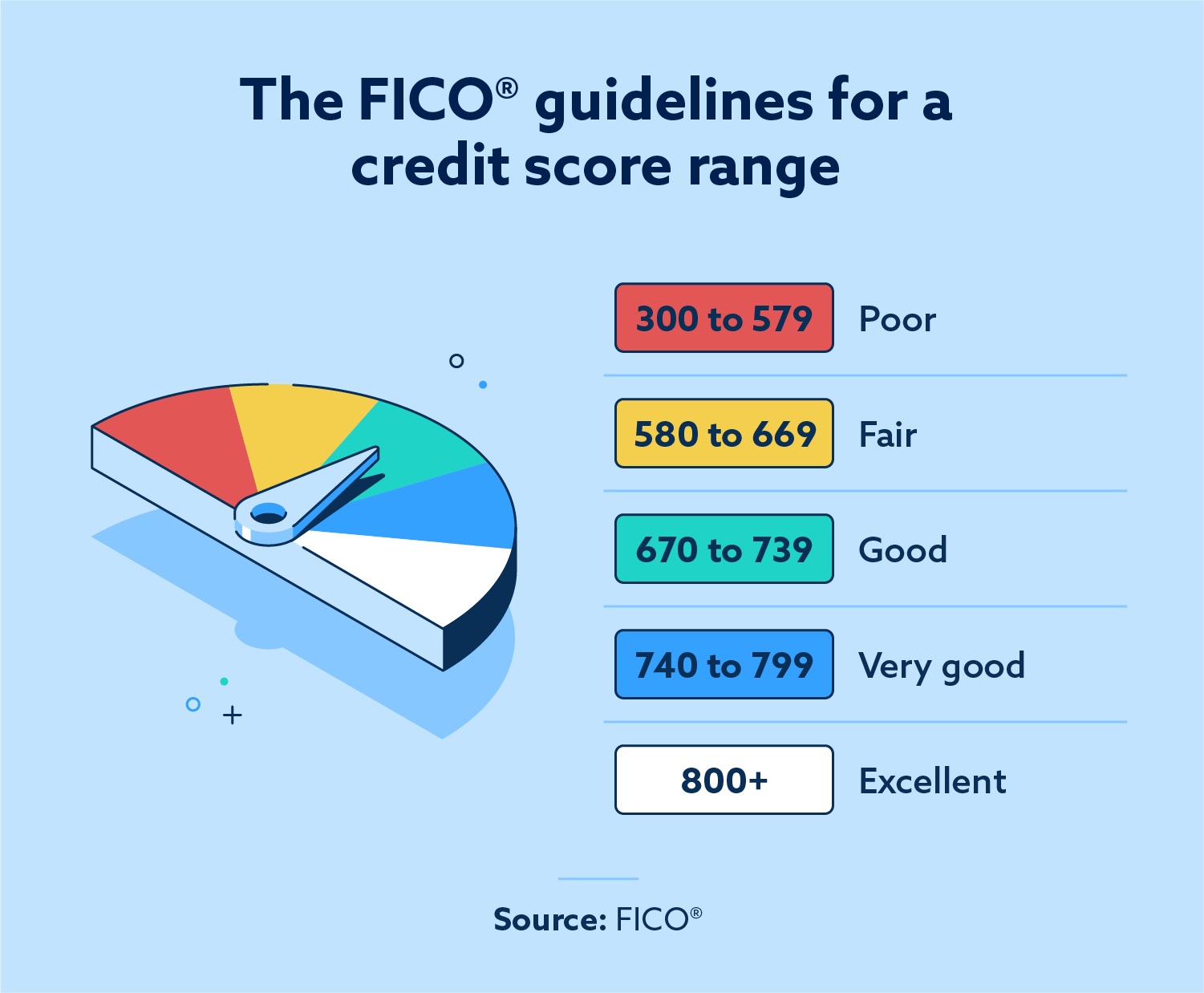

To understand the credit score you’ll need to buy a home, it’s important to first know the ranges lenders use to determine your suitability as a borrower. As most lenders look at FICO scores, it’s safe to use FICO’s credit range breakdown as a guide:

Every lender will have their own specific score minimums for approving a mortgage loan. You can expect most to require at least a “fair” score — somewhere around 600. Many factors affect your credit score, including payment history, the age of your credit, credit card usage and more.

An important factor that mortgage lenders always take into account is your debt-to-income ratio — or the percentage of your monthly income that goes toward paying debts. Like your credit score, your debt-to-income ratio is evaluated in ranges to help lenders assess borrowing power. Your credit score and credit reports are one contributing resource for determining that number.

It’s a good idea to know your credit score and debt-to-income ratio before you apply for a mortgage loan to determine your home buying readiness. If either number needs work, you can take steps to improve it (like lowering credit card usage, for example) before pursuing a new home.

It’s important to enter the homebuying process feeling confident in your ability to afford it, and your credit score is a significant part of it. Let’s look at 4 specific ways your credit score affects your ability to buy a house.

4 Ways Your Credit Score Impacts Your Ability to Buy a Home

Mortgage approval odds

Most obviously, your credit score can affect your mortgage approval odds. If your credit is low or if you have certain negative impacts on your credit (like late or delinquent payments), lenders may decide against offering you a mortgage loan. For this reason, it’s better to work on improving a poor credit score before starting the homebuying process.

Mortgage loan Interest rates

Even after initial mortgage approval, your credit score will affect the interest rate you’re granted on your loan. People with high credit scores will be offered a lower rate, while those with lower scores will have to pay a higher rate. This affects your monthly payment as well as the total interest you pay over the life of your loan.

Here’s an example that demonstrates the concept from mortgage lender American Financing.

To see how your credit score would impact your potential mortgage loan interest rates, you can use free online mortgage loan calculators like this one from NerdWallet.

Number of mortgage lender options

The higher your credit score, the more lender options you’re able to take advantage of. Some lenders may only offer loans to borrowers with high credit scores. If your credit score falls into the lower range of qualified scores (that yellow “fair” range), you may have to stick with more lenient lenders and potentially higher interest rates.

Size of down payment

Indirectly, your credit score could affect the size of the down payment you’re able to put down on a new house. Remember: if your credit score is on the lower end, you’ll need to account for a higher interest rate and thus a higher monthly mortgage payment. This means you may have to reallocate funds saved for your down payment into your future mortgage payments.

Moving to the Dayton area?

Did you know that the greater Dayton area is one of the most affordable metros in the state of Ohio (and the U.S.)? Dayton and its surrounding suburbs feature many unique neighborhoods and great places to live, work, and make a home.

If you’re thinking about moving to Dayton, Oberer Homes can help you find (or build!) a home you’ll love. Contact us today to learn more!

Share this Post